2022 vs. 1979

Volcker was appointed by President Carter in August 1979 with the specific mandate to get inflation under control, which he eventually did but only after introducing some pretty extreme measures. What can Jerome Powell learn from that? Actually what can we all learn from that? Most importantly, that 2% inflation is still far, far away.

Open this issue (PDF)Preview

It is a sobering fact that the prominence of central banks in this century [i.e. the 20th century] has coincided with a general tendency towards more inflation, not less. If the overriding objective is price stability, we did better with the nineteenth-century gold standard and passive central banks, with currency boards, or even with 'free banking'. The truly unique power of a central bank, after all, is the power to create money, and ultimately the power to create is the power to destroy

The 1979-81 battleground

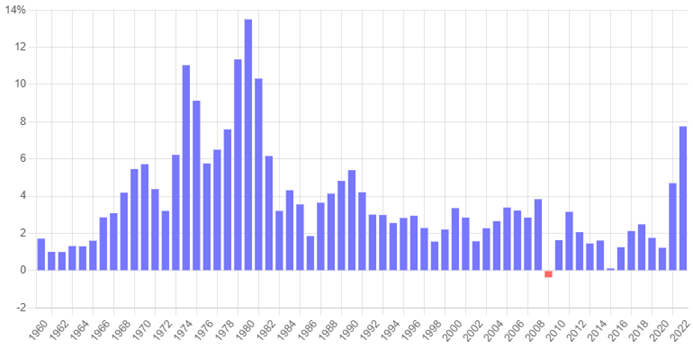

In August 1979, President Carter appointed Paul Volcker as Chairman of the Federal Reserve. Annual inflation was over 11%, not dissimilar to now (Exhibit 1), and Carter’s mandate to Volcker was crystal clear – “do whatever you have to do to bring inflation down”. Volcker acted quickly and raised the Fed Funds rate by 50 bps to 11% within days of taking office. At the same time, he sent a stark warning to all US commercial banks to stop lending to “speculative ventures” which he, at the time, defined as real estate and commodity trading.

Source: US Bureau of Labor Statistics

As it turned out, that did little to curtail inflation and, for the next year and a half, Volcker continued to turn the screw. When he finally stopped in the spring of 1981, the Fed Funds rate had climbed to 20%, an all-time high (Exhibit 2).

Source: macrotrends.net

Lessons learnt from Volcker

The Volcker era taught us several important lessons:

1. When inflation psychology takes hold, aggregate demand stays surprisingly strong, and inflation pressures build further. Only extreme measures from the central bank can reverse that trend.

2. Despite the frequent rate hikes and all the tough talking by Volcker, financial conditions were not nearly tight enough. You have to remove the incentive to take risk for bank lending to cool off.

3. High inflation causes a re-wiring of the entire economy. When that happens, previous correlations break down.

4. It took a while for Volcker to become a monetarist; however, when he did so and prohibited banks from lending, his policy programme started to work.

5. High inflation creates both winners and losers. It is not as one-sided as many think.

Hasn’t Powell learnt anything?

Now, fast forward to early November of this year, and look at the language used by Fed Chairman Jerome Powell after the Federal Reserve Bank delivered its fourth consecutive 75 bps rate hike, bringing the Fed Funds rate to 3.75-4.00%. See an account of it here. Markets had, at first, reacted constructively to the hike, but Powell’s language in the ensuing press conference spooked investors. Statements like “the terminal rate will be higher than previously expected” did nothing to encourage risk-taking, and markets sold off.

Going back to the lessons learnt from the Volcker years, let’s spend a minute on the first lesson referred to above. “Only extreme measures from the central bank can reverse that trend”, I suggested. Powell has said or done absolutely nothing to suggest that extreme measures are on his radar screen – in fact, to the contrary. If the regular rate hikes are reduced to clips of 25 or 50 bps (as Powell hinted at), a signal is sent to financial markets that we are nearly out of the woods now. Such a signal is likely to cause more risk-taking, at least in the short term.

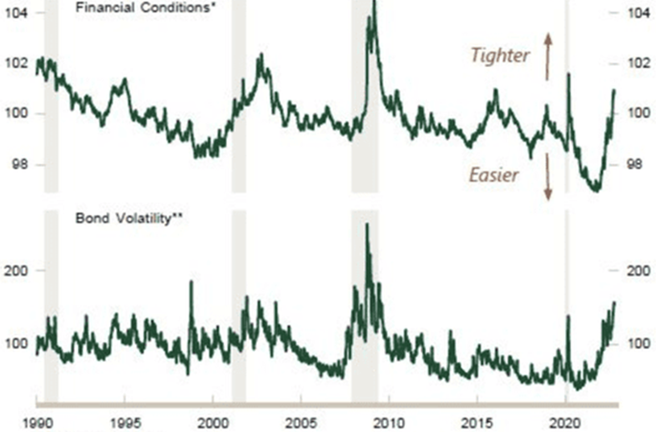

Lesson #2 above provides further evidence that, so far, Powell has failed to deliver medicine strong enough to cool off the economy. Financial conditions in the US are nowhere near tight enough for that to happen. Goldman Sachs runs a Financial Conditions Index (FCI) and, as you can see in Exhibit 3 below, US financial conditions, although tighter than at any other time over the last 2½ years, are nowhere near the extreme levels deemed necessary to cool down an overheated economy.

Source: Goldman Sachs Global Investment Research

Goldman Sachs calculates the index as “a weighted average of riskless interest rates, the exchange rate, equity valuations, and credit spreads, with weights that correspond to the direct impact of each variable on GDP”. The reason the index is such a powerful leading indicator is that the appetite for risk-taking collapses when financial conditions get very tight, and that is the case whether that appetite is defined as the appetite for borrowing amongst consumers and corporates, or we are talking about the appetite for risk-taking in financial markets. And, with a dramatically reduced appetite for risk-taking, a recession and lower inflation almost always follows.

What could be holding Powell back?

A few things spring to mind when I look for reasons why Powell is not acting as aggressively as you might have expected, when looking at Volcker and how successful he was some 40 years ago. First and foremost, although they will never admit to this, Fed officials may have chosen to deliberately stay behind the curve for now. Inflation is a handy way to destroy debt, and the Americans are drowning in debt at the moment (and they are not the only ones).

Secondly, the US economy, anno 2022, is a highly financialised economy, which it wasn’t in 1979, and this may also hold Powell back. He could be worrying (and he may be right) that very high interest rates will do much more damage now than they did in the Volcker years. I haven’t done the maths, but it is pretty obvious that, should the borrowing cost for the US government rise to, say, 10%, the consequences will be dire with so much more debt under the belt. US government debt-to-GDP is 123% at present. When Volcker took charge in 1979, it was 32% (source: thebalancemoney.com).

Thirdly, as I pointed out in last month’s Absolute Return Letter, a different set of policies may be required when inflation is supply-driven rather than demand-driven. I don’t think the current inflation shock is solely supply-driven, but there can be no doubt that supply issues have played a major role in recent months. Labour shortages, agricultural commodity shortages, energy supply problems and supply chain problems in the technology sectors are just some of the problems we have had to deal with more recently. The problem I have with this argument is that supply-driven inflation inevitably affects demand as well, i.e. the two drivers of inflation are more closely aligned than the textbooks prescribe.

Finally, although core US inflation has not yet begun to turn down, the NY Fed’s own measure of underlying inflation has (Exhibit 4), and that has undoubtedly provided the Fed with some comfort. I would expect that comfort to reflect itself in reduced rates hikes over the next few months. Whether that is 25bps or 50 bps is too early to say, though.

Source: Bloomberg

I agree that US inflation may have peaked but, as I said earlier, when inflation psychology takes hold, aggregate demand stays surprisingly strong, and inflation pressures build further. This was probably the single most important lesson learnt from the Volcker years and means that unless the Fed brings much tougher measures into play, we won’t see 2% inflation anytime soon. Inflation may have peaked, but 2% is far, far away.

In that context, I should point out that, last year, the Fed changed the definition of its 2% inflation target. As per the new definition, the Fed will only look at it over the longer term. As they say: “The Federal Open Market Committee (FOMC) judges that inflation of 2 percent over the longer run, as measured by the annual change in the price index for personal consumption expenditures, is most consistent with the Federal Reserve's mandate for maximum employment and price stability.” Therefore, no action shall necessarily be required, even if inflation is running at levels well above 2% for a while. This policy change provides the Fed with the justification they need, if their strategy is to stay behind the curve, as I suspect.

Final few words

The US dollar has been the big winner so far, and that is doing damage to inflation in the rest of the world, which has been hit on two counts. In addition to general inflationary pressures, imported goods priced in USD – most importantly oil – are much more expensive now than at the same time last year. Continental Europeans, for example, pay 13-14% more for their oil than they did in early December 2021. For the Brexit-saddled Brits, it is even worse.

For long, I have been of the opinion that the US dollar would probably peak around the time it became clear the Fed would change pace in its tightening programme, as Jeremy Powell did in early November. So far, that has been a correct call, broadly speaking. However, when I listened to Powell on the 2nd of November and heard him say that “the terminal rate will be higher than previously expected”, I started to dither. The fact that the Fed Funds rate is now expected to go a fair bit higher than previously thought will lend further support to the dollar and drive it somewhat higher, following the current spell of profit taking. The peak is not miles away, though.

It has been quite an extraordinary year. The combination of absurd price increases on many goods and services, a cost-of-living crisis in many countries and an ugly war in Ukraine has made it a year to remember, but not exactly for all the right reasons. On top of all those problems, the poor Brits have also had to deal with the ramifications of an extraordinarily poorly executed Brexit arrangement, but that is a topic for another day. Going into 2023, I think the biggest question confronting investors is whether the current episode of rapid price inflation is marking the beginning of a new regime. Have we, once and for all, ended 40 years of declining inflation, or could Powell ultimately be proven right that the inflation spike is, after all, transitory? I am still in two minds on this question.

Niels C. Jensen

1 December 2022

Investment Megatrends

Our investment philosophy, and everything we do at ARP, is driven by the long-term Investment Megatrends which are identified and routinely debated by our investment team.

Related Investment Megatrends

Our investment philosophy, and everything we do at ARP, is driven by the long-term Investment Megatrends which are identified and routinely debated by our investment team. Read more about related Megatrend/s for this article: